ETH Price Prediction: Path to $5,000 Hinges on Technical Breakout and Institutional Momentum

#ETH

- Technical Resistance Levels: ETH must break above $4,803 (Bollinger upper band) to establish momentum toward $5,000

- Institutional Catalysts: New ETF products and Wall Street integration providing fundamental support for price appreciation

- Market Sentiment Balance: Record stablecoin supply vs. short-term outflows creating both opportunity and near-term resistance

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Resistance

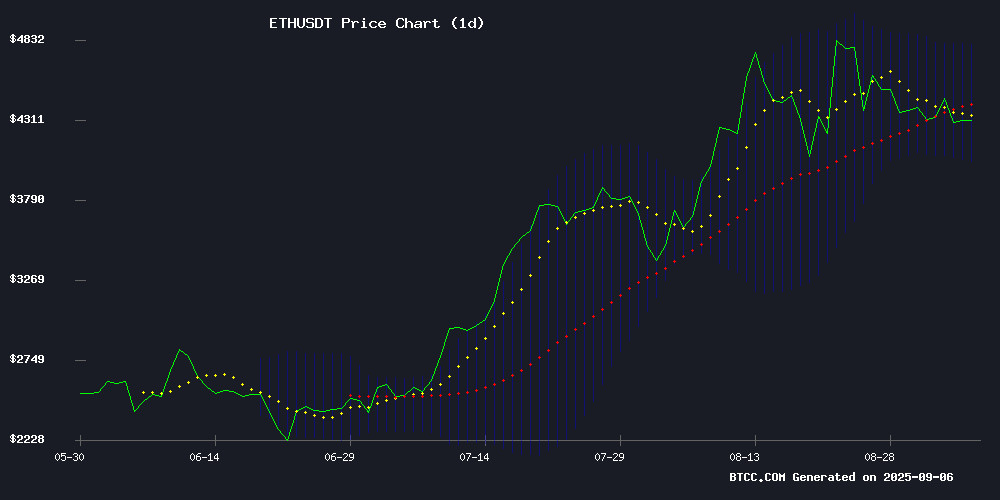

ETH is currently trading at $4,296.55, sitting below its 20-day moving average of $4,422.71, indicating potential short-term bearish pressure. The MACD reading of 104.43 with a positive histogram of 128.80 suggests underlying bullish momentum despite the price dip. Bollinger Bands show ETH trading NEAR the middle band with upper resistance at $4,803.08, which represents a key level for any push toward $5,000.

According to BTCC financial analyst Olivia, 'The technical picture shows ETH consolidating within a range. Breaking above the 20-day MA could trigger momentum toward the upper Bollinger Band, but sustained volume will be crucial for any attempt at $5,000.'

Market Sentiment: Institutional Developments Offset by Short-Term Outflows

Recent developments present a mixed sentiment landscape for Ethereum. Record stablecoin supply of $172.2 billion on ethereum indicates robust ecosystem activity, while Grayscale's new covered call ETF and Etherealize's $40 million funding demonstrate growing institutional sophistication. However, the $447 million outflow from spot ETFs and Binance supply contraction suggest short-term caution among some investors.

BTCC financial analyst Olivia notes, 'The fundamental story remains strong with Wall Street integration accelerating, but traders should monitor whether the spot ETF outflows represent a temporary rotation or sustained risk-off sentiment that could delay the $5,000 target.'

Factors Influencing ETH's Price

Stablecoin Supply on Ethereum Hits Record $172.2 Billion

Ethereum's stablecoin supply has surged to an all-time high of $172.2 billion, fueled by aggressive minting from leading issuers such as USDC and USDT. This milestone underscores Ethereum's expanding hegemony in the stablecoin arena, reinforcing its infrastructure for trading, lending, and decentralized finance applications.

Regulatory tailwinds and mounting institutional participation have accelerated this growth, solidifying Ethereum's position as the backbone of crypto's financial evolution. The network now operates as the de facto settlement layer for dollar-pegged assets, bridging traditional finance with blockchain innovation.

Ethereum Price Holds Steady as Binance Supply Shrinks

Ethereum's price remains resilient near $4,330 as investors take note of declining exchange balances on Binance. The outflow of ETH from the platform suggests a reduction in immediate sell pressure, often a precursor to bullish momentum. Historical patterns indicate such movements typically precede price breakouts.

Binance's Ethereum Exchange Supply Ratio dropped from 0.041 to 0.037 between mid-August and early September, according to CryptoQuant data. This shift signals holders are moving coins into long-term storage rather than keeping them available for trading. The supply squeeze coincides with ETH maintaining stability just below $4,400, despite earlier highs near $4,946.

Technical indicators show Ethereum consolidating after its late-August peak. Narrowing Bollinger Bands reflect subdued volatility—a characteristic pause before potential upward movement. Market participants appear to be positioning for the next leg higher as exchange reserves dwindle and prices hold firm.

Ethereum Spot ETFs See Second-Largest Single-Day Outflow at $447M

Ethereum spot ETFs bled $446.71 million on September 5, marking their second-worst redemption day since launch. Only August 4's $465.06 million outflow was larger. The exodus comes as ETH consolidates near $4,300 after failing to hold $4,900 highs earlier this month.

BlackRock's iShares Ethereum Trust (ETHA) led the retreat with $309.9 million withdrawn, followed by Grayscale and Fidelity. Cumulative inflows now stand at $12.73 billion - a three-week low after peaking at $13.51 billion in late August.

The selloff extends a September trend, with $787.74 million exiting last week alone. This erased the previous week's $1.08 billion inflows, suggesting institutional investors are taking profits after ETH's 35% summer rally.

Grayscale Launches Ethereum Covered Call ETF to Generate Steady Income from Volatility

Grayscale has rolled out a novel Ethereum-focused exchange-traded fund (ETF) aimed at converting the cryptocurrency's notorious price swings into reliable investor income. The Grayscale Ethereum Covered Call ETF (ETCO), launched September 4, sidesteps direct ETH exposure in favor of a derivatives-based strategy that sells call options on existing Ethereum products like the Grayscale Ethereum Trust.

The fund targets yield-seeking investors by writing options near spot prices to capture premium income, which may also cushion against downside volatility. "This income-first approach transforms ETH's turbulence into cash flow opportunities," said Krista Lynch, Grayscale's ETF senior vice president. The move comes as traditional Ethereum ETFs face significant capital outflows.

Tom Lee Predicts 54X ETH Price Rally As Firm Bets $40M On Wall Street Push

Fundstrat, led by Tom Lee, forecasts a staggering 54-fold surge in Ethereum's price, drawing parallels to its historic 2018-2020 consolidation phase that preceded a rally to $4,866. The analysis hinges on the Wyckoff principle, suggesting prolonged sideways movement often culminates in explosive breakouts.

Etherealize has secured $40 million from venture heavyweights to accelerate institutional Ethereum adoption, signaling growing confidence in the network's long-term viability. A new $100 million ETH whale has emerged amid a 14% increase in large holder positions over five months.

Despite recent price stagnation, the market structure remains bullish. Historical patterns indicate Ethereum's current consolidation could mirror the extended base formation that preceded its last major rally, though such extreme gains would require clearing critical resistance levels.

Ethereum's BETH Token Emerges as Novel Burn Mechanism Byproduct

The Ethereum ecosystem has introduced a curious new asset class through its EIP-1559 burn mechanism. For every 1.99 million ETH (valued at $8.8 billion) permanently removed from circulation, participants now receive BETH tokens - immutable ERC-20 receipts documenting the destruction.

Created by Ethereum Community Foundation's Zak Cole, these non-redeemable tokens represent a radical experiment in value attribution. "BETH will see community adoption," predicts Ethereum co-founder Joseph Lubin, though market pricing remains speculative. The tokens serve purely as burn verification, raising philosophical questions about valuing destruction certificates.

Since August 2021, EIP-1559's fee-burning has systematically tightened ETH supply. This deflationary pressure continues reshaping Ethereum's monetary policy, with BETH emerging as an unintended but fascinating market derivative.

Buterin-Backed Etherealize Raises $40M to Bridge Wall Street and Ethereum

Etherealize, a business development startup with ties to Vitalik Buterin, secured $40 million in funding from Paradigm and Electric Capital. The firm aims to accelerate institutional Ethereum adoption by tokenizing Wall Street assets and enhancing private settlement infrastructure.

The announcement follows the Ethereum Foundation's sale of 10,000 ETH worth $43 million, highlighting parallel efforts to expand Ethereum's ecosystem. Etherealize positions itself as complementary to—rather than competitive with—the Foundation, focusing on educational initiatives and institutional-grade applications.

CEO Vivek Raman, a Wall Street veteran, leads the charge to establish Ethereum as a digital reserve currency. The funding will fuel infrastructure development targeting asset managers and traditional finance institutions.

Hackers Exploit Ethereum Smart Contracts to Conceal Malware in Open-Source Libraries

Cybercriminals are leveraging Ethereum smart contracts to embed malicious code within open-source libraries, marking a sophisticated evolution in software supply-chain attacks. Research from ReversingLabs reveals that attackers now store command-and-control instructions on the blockchain, evading traditional detection mechanisms. This method complicates efforts to neutralize threats, as defenders can no longer rely on flagging hard-coded domains.

The campaign primarily targeted npm, the JavaScript package repository, with two malicious packages—'colortoolsv2' and 'mimelib2'—identified in July. These packages executed obfuscated scripts that retrieved payload locations from Ethereum contracts, bypassing conventional security measures. Fake GitHub repositories further amplified the attack, rotating dependencies to maximize infection spread.

Blockchain's immutability, once hailed for its security benefits, is now being weaponized. The technique underscores a growing trend of cybercriminals adopting decentralized technologies to enhance their operations. While Ethereum remains a cornerstone of decentralized finance, its misuse highlights the need for enhanced vigilance in open-source ecosystems.

Will ETH Price Hit 5000?

Based on current technical and fundamental analysis, ETH reaching $5,000 remains plausible but requires specific catalysts. The price must first conquer the 20-day MA at $4,422 and then break through Bollinger upper resistance at $4,803. Key factors that could drive this move include:

| Factor | Current Status | Target Impact |

|---|---|---|

| Technical Breakout | Needs to clear $4,803 | High |

| ETF Flow Reversal | Currently negative | Medium-High |

| Institutional Adoption | Accelerating | High |

| Market Sentiment | Mixed | Medium |

BTCC financial analyst Olivia suggests 'While Tom Lee's bullish prediction captures long-term potential, traders should watch for consolidation above $4,400 as the first sign of momentum building toward $5,000. The combination of technical breakout and sustained institutional interest could achieve this target within the current market cycle.'